The Global True Wireless Earbuds Market 2022

Growing trends in true wireless earbuds including market size, competitive landscape, consumer preferences, and white space opportunities

Report Contents

Forward and Macro Trends

Pricing Strategy and Analysis

Geographic Analysis and Market Size

SWOT Analysis

Competitive Landscape

Product Comparison

White Space Analysis

Technical Analysis

Insights and Conclusions – Contact Us

Author: Susan Moore

Report contents updated July 15, 2022

Forward and Macro Trends

The global market for true wireless stereo earbuds is calculated at USD 25.32 billion in 2020 and is said to grow at a combined annual growth rate (CAGR) of 36.1% from 2021 to 2028. Media and short video applications are estimated to accelerate the growth of the earbud market in the true wireless stereo (TWS) market in the next few years. The TWS earbuds are an essential part of the intelligent audio device industry, and some are said to be witnessing strong growth during the forecast period. The industry has already seen the benefits of integrating several sensors into one device. However, from now on, significant technological advances, including the development of robust and economic Bluetooth chips with long battery life, will pave the way for market growth.

In 2020, the Asia Pacific region had a higher proportion of the market because of the high demand for items with a list price of less than USD 100. Customers in APAC are looking for both high-end and low-cost items as the industry shifts. Buyers from Japan and South Korea choose sound quality and luxury above pricing when purchasing high-end items. However, Southeast Asian nations have shown a high tendency for low-to-medium-sized devices. Demand for low-cost devices in APAC is said to grow in the forecast period as retailers like Xiaomi and Realme strive to improve product availability in price-sensitive markets.

The disruption of the COVID-19-led supply chain has caused a slight decline in the industry. Production of TWS earbuds in China had an impact in early 2020; however, it returned to full use by the second quarter. The epidemic did not, however, affect consumer demand as the highest proportion of product sales is online. The growing demand for productivity / domestic work has kept market growth steady in times of violence.

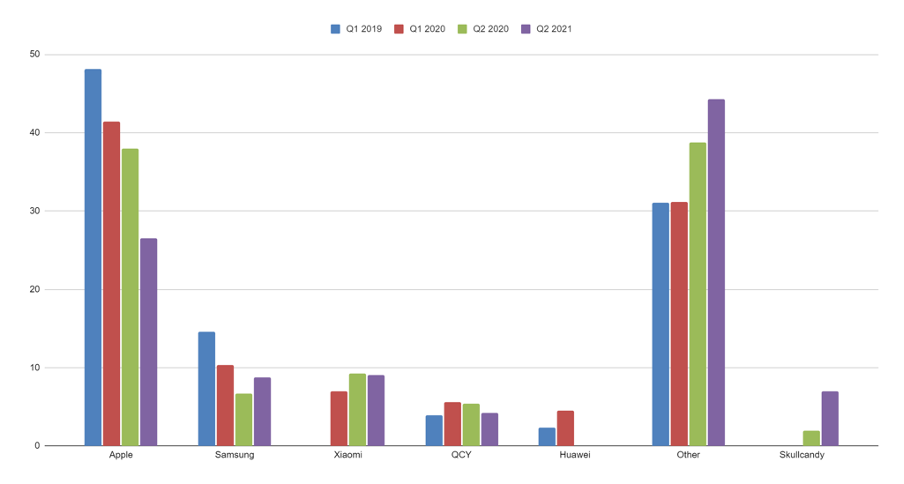

Market share of the leading true wireless stereo (TWS) vendors as of 2nd quarter 2021

Pricing Strategy and Analysis

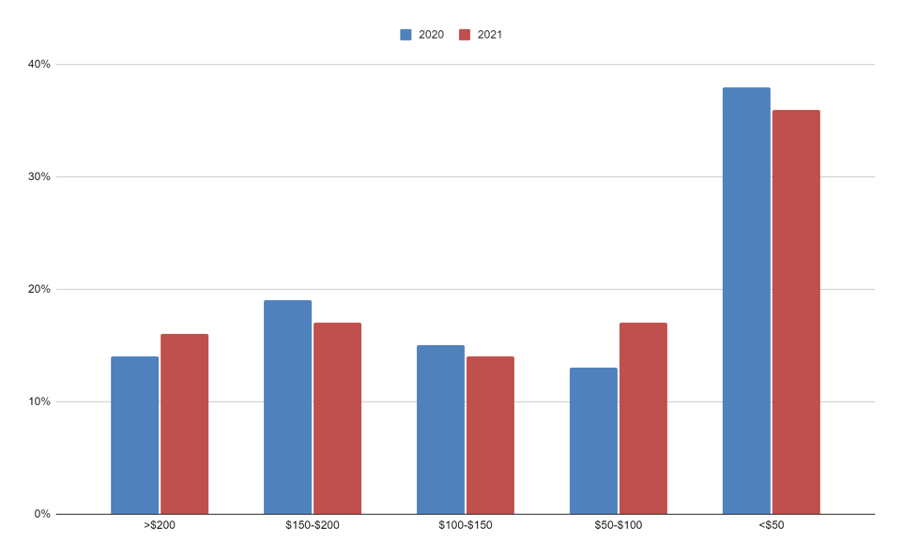

By 2020, part of the price band USD 100-199 had a larger revenue share of more than 50%. Vendors such as Apple Inc., Samsung Electronics Co. Ltd., and Jabra contributed to the market share. Apple Inc. will continue to dominate the global audio market over the next few years. However, the economic downturn and related uncertainty caused by the COVID-19 epidemic have boosted the growth of the price band below USD 100.

Chinese and Indian brands, such as Xiaomi, Baseus, boAt, Noise, and PTron, have introduced several products in the price band below USD 100. -earbud at TWS worldwide by 2020. As the impact of this epidemic diminishes, the demand for intermediate products will likely gain momentum and move forward. The launch of new creations under the price band USD 100-199. Companies such as Apple Inc., Sony Corporation, and Jabra have introduced new products at a low to medium price by 2021.

According to a consumer study, half of the existing TWS users in India want to purchase their next TWS gadget within the next year. In addition, the ASP of India’s TWS market is anticipated to climb to the range of INR 5,000 to INR 10,000 price band. Approximately sixty percent of existing TWS customers in India want to continue using TWS for their next hearing aid purchase. The respondent’s future TWS purchases will be most influenced by battery life, audio clarity, and voice quality. Due to COVID-19, the majority of India was subject to lockdowns or limitations, resulting in longer work/study from home. Consequently, a significant proportion of respondents, regardless of employment, spent money on hearing aids such as TWS. The results of the study show that the market will continue to get robust support beyond the epidemic.

Geographic Analysis and Market Size

North America led the TWS market for overseas earbuds by 2020 with a share of more than 37%, closely followed by the Asia Pacific. The popularity of AirPods has contributed to furthering the need for TWS in North America. Several smartphone retailers have introduced wireless earbuds with unique connections to their devices. With the rapid growth of smartphone switching cycles, more consumers are investing in related products. Smartphone retailers are going to take advantage of these opportunities. The advent of high technology and the early availability of newly launched products are also key factors contributing to market growth.

China and India are said to lead the Asia Pacific regional market due to the emergence of a few suppliers that offer products full of features at competitive prices. Many Chinese and Indian retailers are looking for growth opportunities in overseas markets. Well-established retailers are making money in the supply chain to grow their e-commerce sales across the border. In addition, these vendors offer affordable and attractive products that fit well with a large audience. The Asia Pacific provides a large customer base and several market growth opportunities with low entry barriers. It is anticipated that these factors will raise product sales in the Asia-Pacific region, which will surpass North America in terms of revenue during the projected period.

India’s smart audio market grew by 62 percent in the third quarter (Q3) of 2021, with 16.6 million units exported, bringing its global market share to 14 percent. The TWS (true wireless stereo) segment was the most significant driver in India, growing by 92 percent to reach 7.3 million units. India’s true wireless market (TWS) continued to grow in the first quarter of 2021. Due to new launches and improved features, the Indian TWS market saw an annual growth rate of 156% per annum in Q1 2021.

Enhancements in features like sound quality, low latency for a superior gaming experience, smart touch control for a hassle-free experience, and water and dust resistant certifications have contributed to the expansion of the TWS market in India. The local brand’s foothold in India’s TWS market has strengthened. They now control three of the top five spots in exports, accounting for over 40 percent of the total and maintaining its dominance.

True Wireless Earbuds SWOT Analysis

Strengths :

- ● Growing market

- Upcoming supporting niches

- Becoming a product in the necessary category

Weaknesses :

- Competitive low pricing in the existing market

- High reputation for existing products

Opportunities :

- New features to be integrated into the products

- Disruptive marketing campaigns

- Increasing demand for products

Threats :

- High competition

- Fluctuating market

- The increasing price of raw materials

Bluetooth Earbuds Competitive Landscape

The market is competing with retailers, such as Apple Inc., Bose Corp., Sony Corp., and Skullcandy.com, which holds most of the market. Market players focus on introducing new product features to improve comfort; for example, Apple Inc. AirPods introduced a unique ventilation design that is equal to the pressure inside the ear to reduce discomfort, which is common in models inside the ears. AirPods has seen significant growth in sales since its launch in December 2016. Numerous large brands are, however, losing market share to Chinese merchants and local businesses that provide alternative features at cheaper rates. Some of the leading participants in the global true wireless stereo earbud market are:

- Apple, Inc.

- Bose Corp.

- Jabra

- Harman International Industries, Inc.

- Sony Corp.

- Sennheiser Electronic GmbH & Co.

- Xiaomi

The Boat has been the leading brand in India for three straight quarters. The firm has three of the top five models for shipping in Q1 2021, accounting for over half of the top five model shipments. The Boat Airdopes 131 model fared well and climbed to the number two spot, with its shipping share growing by over 7 percent. The second position is held by OnePlus, primarily because of its Buds Z model, which maintained its status as the best-selling model in Q1 2021 with a nearly 10 percent market share. The Final Horizon Sale considerably increased OnePlus’s growth. Realme retained its third-place standing in Q1 2021, with a year-over-year growth rate of 125%. Its Buds Q variant has likewise remained among the top five best-selling versions. Ptron attained the fourth position by releasing many new releases at low costs, including the Bassbuds Vista, Bassbuds Pro, and Bassbuds Jets. Noise secures the fifth spot on the list by delivering the latest releases among the top five brands throughout the quarter.

Based on a study of consumers done in India utilizing an online survey panel comprised of a diverse set of TWS users. A sample of 1,027 respondents was obtained using the quota-sampling approach to more accurately reflect the condition based on the current market share of the TWS brand. As a result, boAt was the brand consumers preferred for future TWS purchases. Approximately sixty percent of existing TWS customers choose boAt for future TWS purchases. Following boAt include JBL, Samsung, OnePlus, and Apple. From 28 percent of respondents now using boAt TWS earphones to 58 percent considering it as their future purchase, boAt’s popularity continues to rise. JBL’s TWS devices also look to be gaining market share, with more than 40 percent of respondents selecting it for their next buy, up from less than 10 percent now.

Despite being a more recent technology in India, TWS has a more significant number of market participants, giving customers more alternatives. Major firms are attempting to manufacture their products domestically to gain the advantages of the government’s PLI (Production-Linked Incentive) program; consequently, the market share is divided among several competitors. Nonetheless, boAt remains the best player. The sound quality of boAt TWS is favored the most, followed by its battery life. Price is usually a deciding factor when purchasing, particularly in a market category with ample room for growth and innovation. The price range of INR 5,000 (63.31 USD) and above now accounts for 27 percent of the TWS market. Forty percent of respondents expect to buy their next gadget within the same price bracket.

Apple retained its global position at TWS, shipping 17.8 million units. Still, its exports dropped by almost a third compared to last year due to a sharp decline in demand as consumers wait for third-generation devices. Samsung, backed by solid performance since the launch of the Galaxy Buds 2, as well as the latest additions from the JWL TWS entry list, also secured second place. Xiaomi, which has yet to upgrade its affordable Redmi system after focusing its attention on high-end devices, has moved to third place. India’s local leader, boAt, entered the top five for the first time, sending 2.8 million units. Edifier was close behind by 2.7 million units. The next quarter will be promising when TWS deployment surpasses wireless earbuds in India and other regions. Given the supply chain challenges and the need for domestic production, the challenge lies in ensuring sustainable supply.

Some of the main players in the market for true wireless stereo earbuds in India include:

- Sony WF-1000XM4

- Samsung Galaxy Buds 2

- OnePlus Buds Pro

- Oppo Enco Air 2 Pro

- boAt Airdopes 441 Pro

- Skullcandy Dime True Wireless Earbuds

- Boat Airdopes 621 TWS Earbuds

Wireless Earbuds Product Comparison

1. Sony WF-1000XM4

If one has a big ear, the new 1000XM4 headphones’ extraordinarily compact size and well-balanced positioning on the ear make them quite discreet when used. Although the body of these models has become much more compact, this does not entirely resolve the problem that some users experience with these headphones. The charging cover is also surprisingly tiny, seeming impossibly little compared to the previous model (which was 40 percent smaller), which already appeared to be a compact gadget.

Sony is too fond of noise-canceling technology in its headphones. Given the headphones’ size, the manufacturer again displays why it is the best by isolating music from ambient noise. The device’s primary components are the brand’s V1 CPU and cancellation microphones, which will be responsible for completely isolating you from your surroundings using the appropriate algorithms.

Dimensions: 4 x 6.9 x 3 cm (case)

Waterproof: IPX4

Size & Weight: WeightApprox. 41 g

Price: 280$

Pros:

- Best noise reduction in true wireless earbuds with 360-degree compatibility for high-resolution audio

- Incredible battery life

- Durable with respect to comfort

- Hi-Res Wireless Audio with LDAC support

- Adjustable EQ

- Simple and trustworthy touch controls

- Compact carrying bag with wireless charging capabilities

Cons:

- The absence of Bluetooth multipoint

- Absence of Qualcomm aptX support

- Not suitable for little ears

- New ear tips might be unconventional.

- Speak-to-chat is convenient yet flawed.

- High cost

- No realistic option for volume control

2. Samsung Galaxy Buds 2

Samsung is very determined to compete with its rival in other categories, such as personal audio, and head-to-head. The newest pair of noise-canceling earphones in Samsung’s somewhat mystifying lineup are the Galaxy Buds 2. This time, the company combines Bluetooth 5.2 with high-end capabilities like active noise cancellation (ANC) for an affordable price. The Galaxy Buds 2 may be overshadowed by its siblings, the Galaxy Buds Pro and Galaxy Buds Plus, despite the fact that they have a lot going for them. These mid-range headphones must still be useful to someone. Both the earphones and the USB-C casing of the Galaxy Buds 2 have a pleasant, rounded shape. It’s unfortunate that Samsung didn’t provide detachable wing tips with this model because they would have made the fit more secure. Automatic play/pause while removing the earbuds is made possible via a proximity sensor, and it operates quite dependably. Reinserting the earbuds does not automatically resume playback; you must tap one of the touch panels to do so.

Samsung always packs its headsets with plenty of advanced technology and sensors. The Galaxy Buds 2 often registers accidental taps when adjusting the earbuds, something that happens often and sends media into a syncopated frenzy of skips and pauses.

Weight: 5g (earbud)41.2g (case)

Dimensions: 17 x 20.9 mm (earbud)50.2 x 50 x 27.8 mm (case)

Price: 90-100$

Pros:

- Compact design

- In-app ear tip fit test

- Sound quality

- Bluetooth 5.2 with SBC, AAC, and Samsung Scalable codec

- Fast and wireless charging

Cons:

- No iOS app support

- Lacks aptX

- Not compatible with Samsung 360 Audio

- Sensitive touch controls

3. One plus buds pro

The OnePlus Buds Pro ticks many of the correct boxes, but they lack several essential components that are included in other true wireless earbuds, most notably the option to adjust the sound. Although this headset doesn’t stand out from the competition, it nonetheless accomplishes everything just well enough to meet the needs of the majority of users.

A red and white cardboard box serves as the only form of packaging, and the only included accessories are a set of ear-tips in three sizes and a USB to USB-C adapter.

The design of these earphones is if there is one area where OnePlus really excelled. Both the Buds Pro and their case are quite appealing. Although they are relatively basic, their appeal may stem from their simplicity. Additionally, they have IP55 certification, which guarantees the earbuds won’t be harmed if used in conditions like exercising, being in the rain (or the shower), or other comparable circumstances.

They may have a problem with them because of how shallow their fit is. The fact that the nozzles are so short and barely protrude from the shell suggests that they are intended to remain at the opening of your ear canal rather than go into it.

Dimensions: 32 x 23.2mm (earbud)60.1 x 49.1 x 24.9mm (case)

Weight: 4.35g (earbud)52g (case)

Price: $149.99 USD

Pros:

- Beautiful design

- Small and portable case

- High-quality LHDC codec

- Very effective ANC

Cons:

- Limited technicalities

- Treble can be aggressive

- Fit is not for everyone

- Some features locked to OnePlus phones

4. Oppo Enco Air 2 Pro

The 12.4mm tetanized diaphragm drivers in Oppo’s brand-new fully wireless earbuds are impressive. It has a stem and an in-ear design. Additionally, the earbuds have artificial intelligence-based noise cancellation for calls and active noise cancellation technology with a transparency mode. Bluetooth 5.2 is available for connecting with a 10-meter range on the Enco Air2 Pro. A 43mAh rechargeable lithium-ion battery is included with the earbuds. On the other hand, the charging case receives a 440mAh battery. It charges with a USB Type-C connection. On a single charge at 50% volume, music playback time with noise cancellation is 5 hours for the earphones and 20 hours for the charging case. The battery life increases to 7 hours for the earphones on a single charge at 50% volume and 28 hours for the charging case when noise canceling is turned off. The charging time for the earphones is 90 minutes, but the total charging time for the earbuds and charging case is 120 minutes.

Product Dimensions, 25.4 x 5.1 x 6.9 cm.

Weight: 3 Grams.

Price: 45$

Pros:

- Long-lasting battery

- The 10-minute playback charge for two hours

- The sound quality is good

- Integrated touch controls

Cons:

- The case is not water- or dust-resistant

- Chargerе case prone to fingerprints and scratches

- Not aptX

5. Boat airdrops 441 Pro

The boat 441 Pro earbuds are manufactured of high-quality plastic and are exceptionally lightweight. They contain touch controls to operate the earbuds and a microphone on one side for taking calls. Bright neon and black are combined to create a color that is sure to catch everyone’s eye.

These earbuds also have additional silicon wings that resemble wings and are flexible enough to go over the ears, giving the earphones more support. The 6mm dynamic audio drivers in the boat airdopes 441 Pro earphones provide a respectably powerful sound. The bass is strong and deep. It has a pleasing touch to the sound because it is neither too much nor too little. The treble, highs, mids, and lows are all very clear and crisp.

Occasionally, there is no problem when using the box airdopes 441 pro earbuds at maximum volume. However, the bass can occasionally become overly strong and obtrusive at higher volumes, making the vocals rather muddled.

Price: 30$

Pros:

- Lightweight

- Ear grip

- RGB lighting

- Easy CTC control

- 150 hours playtime

- IPX7 Sweat and Water-resistant

- USB Type-C charging

- 2,600 mAH charging case with reverse charging

- No active noise cancellation

- No wireless charging

- Bluetooth range

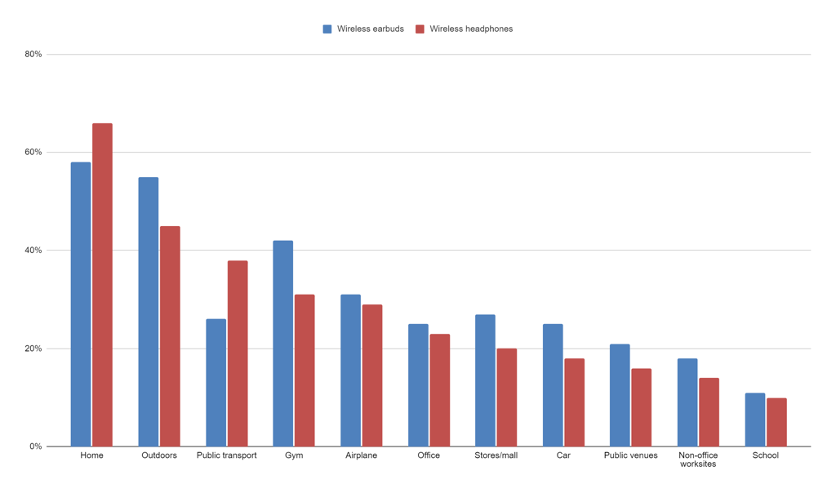

True Wireless Earbuds Market Drivers

The market for TWS earphones has evolved from a luxury to a norm. The year-over-year growth of the market and sales has spurred the fast expansion of the Bluetooth headset industry and created several new prospects. Beginning in 2016, Apple will discontinue the 3.5mm audio interface on iPhone 7 series mobile devices and introduce a new range of truly wireless AirPods headphones.

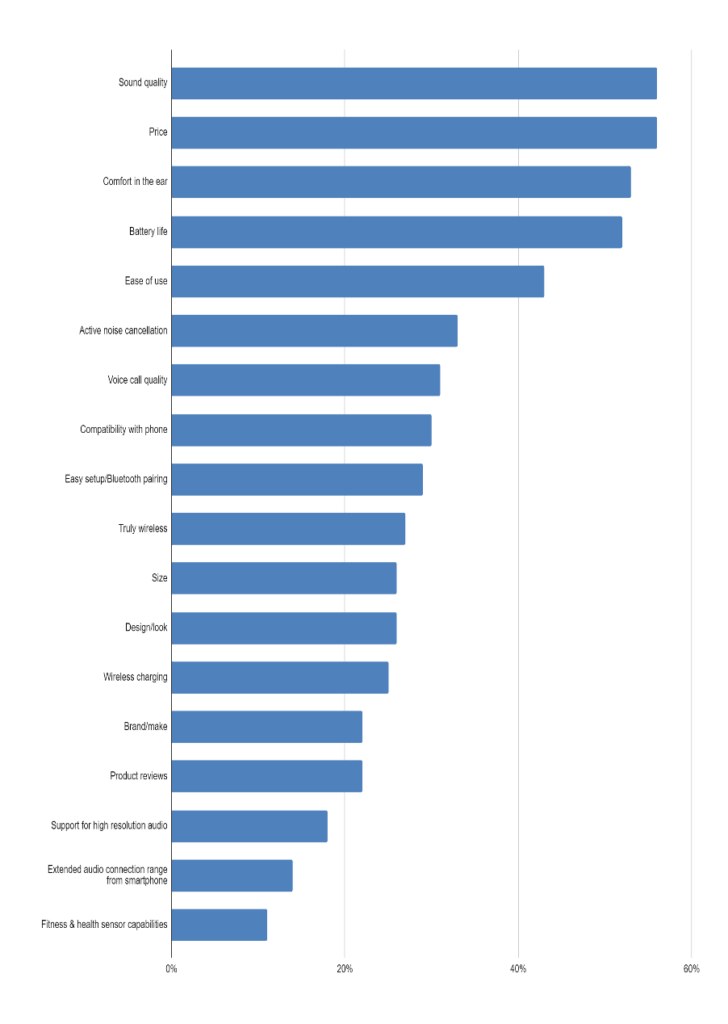

The launch of the Apple AirPods played a crucial role in leading the market growth in 2016, and several players, including smartphone and audio manufacturers, are following suit. Since its introduction six years ago, TWS has emerged as the fastest-growing intelligent personal audio market segment. The adoption of these devices has also led to the developing of a global supply chain with technological advances focused on the primary control chip, power management, and earplug battery, among others. Apart from technology, comfort and sound quality are said to continue to be the main driving forces of the market. Features, such as cable performance and over 70% battery life, make these devices popular among users.

As a colossus in the world of science and technology, the growth of a new product line signifies the direction of the industry’s future development. As soon as Apple released its AirPods, this dual-channel transmission technology with a charging compartment solution dominated the market. Android and audio makers have followed suit, and many new companies have joined the competition. The TWS true wireless earbuds have become the fastest-growing consumer electronics product after more than four years of development.

In the present TWS headset market, the mobile phone brand based on the massive user base of the mobile phone market and the enhanced user experience brought about by dual-end optimization has a prominent position. Although Apple’s market share is dropping, it still holds up to 40 percent of the market and is in the lead. And Xiaomi, Samsung, Huawei, Realme, OPPO, Etc. follow in succession, and the most cost-effective firms, led by M&C, have progressively increased their market share.

The fast development of TWS true wireless headphones has also resulted in the modernization of essential supply chain firms. In addition, improvements have been made to the central control chip, power management IC, wireless charging receiver chip, charging box battery, earbud battery, and touch control. The functionality and performance of TWS headsets enhance the user experience. The formation of a virtuous loop has contributed to the steady and healthy growth of TWS genuine wireless headphones.

Earbuds also gain prominence as a hearing aid. Hearing aids are increasingly being integrated into earbuds by manufacturers to serve better those who suffer from hearing loss. An ID for TWS earbud’s microchips has been created by companies such as Nuheara Limited and Apple Inc. They’ll utilize the microchip’s ear profile and listening skills to build user-generated audio IDs. Noise passes through the earbud hardware and is increased or reduced based on user-set configurations with hearing aid technology. Such developments allow retailers to introduce new product features, reflecting future market growth positively.

True Wireless Earbuds White Space Analysis

1. TWS earphone product form: bean-shaped, bing-shaped, sports hanging ears

Even though the current TWS true wireless earbuds have their unique qualities, they are primarily available in two forms: “handle-shaped” and “bean-shaped,” and in-ear earphones with earplugs and semi-in-ear headphones without earplugs. There is also a device with an ear hook primarily aimed at the sports market and may give more steady wearing.

In-ear earphones are firmly linked to the ear canal due to the earplug’s availability. Semi-in-ear earphones provide a pleasant wearing experience, and the music sound field is quite comfortable; they do not cause dull pressure or pondering. Strong airtightness is more favorable to the active noise reduction function; however, “bean-style” headphones are smaller, lighter, and more aesthetically pleasing and easy to use. In 2020, the active noise reduction capability was widespread and included in the mid-to-high-end flagship goods of various companies. In 2021, the costs of items that enable active noise reduction continued to fall, and the standard active noise reduction age started.

The 1MORE ComfoBuds Pro, Huawei FreeBuds 4i, Soundcore sound-wide noise reduction chamber, Samsung Galaxy Buds Pro, Little Bird Libratone AIR+ 2nd generation, and other devices had active noise reduction and an in-ear design, for instance. Only Samsung has a bean-like form, while the others have a shank-like look.

Despite each manufacturer’s unique aesthetic design style, an increasing number of new TWS earphones feature a handle-shaped in-ear design. This construction is more suitable for signal stability, sound transmission, and mass consumption. Positive customer response demonstrates an appreciation for the handle-like form. In addition to the reasons described above for the active noise reduction feature, the inclusion of functionalities such as call noise reduction, bone conduction, and spatial audio also need more firmware support space. Therefore, the handle-shaped in-ear design may continue to be the most popular kind of TWS earphones in recent years.

2. Standards for Bluetooth audio technology: Bluetooth 5.2 and LEAudio

The introduction of Bluetooth technology represents a significant turning point in the evolution of headphones. It effectively lowers the wire’s restrictions on earphone usage, setting the groundwork for the emergence of TWS true wireless earphones.

In 2020, Bluetooth SIG (Bluetooth SIG) introduced LE Audio, the next-generation Bluetooth audio technology standard. Based on the Bluetooth 5.2 standard, the new LC3 high-quality, low-power audio decoder is adopted; the application of Bluetooth technology is integrated to include support for multi-stream audio and broadcast audio technology; future TWS headsets may offer robust support for hearing aids. The role provides several new growth avenues; now, at least nine significant companies have introduced sixteen new headsets that enable Bluetooth 5.2. The majority will swiftly use these two technologies in the future to improve the user experience of TWS headphones.

3. Special audio capabilities: spatial audio and 360-degree surround sound

The unique sound effects of TWS true wireless earbuds are another highly valued characteristic. Apple’s spatial audio, Sony’s 360 live sound effects, and the most recent 360-degree sound effects from Samsung are the primary applications now implemented on TWS headsets. The direct similarity is that it may deliver an immediate audio experience while viewing a video.

Apple introduced spatial audio at the WWDC20 Global Developers Conference. Apple’s truly wireless AirPods Pro headset is the first device to offer this capability. In 2020, Apple will unveil the AirPods Max headgear, enabling spatial audio. According to recent reports from my love audio, Apple’s soon-to-be-released AirPods4 may also have this feature.

Adding directional audio filters, fine-tuning the frequency heard by each ear, and employing acceleration sensors and gyroscopes to measure head motions and evaluate them based on the movement data of the relative movement of the head and the screen are the primary components of spatial audio. Use situations such as a vehicle’s turning and an aircraft’s fuselage tilting to continually remap the sound field location to provide an immersive audio experience.

Sony debuted the 360 Reality Sound audio technology at the CES International Consumer Electronics Show. It incorporates concert-like live musical instruments into a 360-degree spherical area and reproduces the headset’s music based on the collected distance and angle data. The immersive music experience makes the listener feel like they are in the music.

4. Methods of intelligent interaction: voice interaction, gesture control, pressure sensing, and translation function

The present interactive experience of TWS true wireless headphones consists primarily of physical buttons, touch buttons, pressure-sensitive buttons, and a mix of touch and pressure-sensitive control mechanisms.

The pressure-sensitive button combines the several benefits of its predecessor. It achieves a control technique equivalent to a physical button without compromising the aesthetics of the headset and offers a high degree of sensitivity and precision. It also prevents erroneous touches.

Intelligent voice assistant

Intelligent speech interaction is now a technique to operate TWS true wireless headphones, but it is mainly implemented via the voice assistant of the connected terminal device; therefore, it must be supported by the connected device and can only be activated by pressing a button.

Gesture control

Gesture control is a revolutionary interactive technology that has been successfully used on touchscreen smartphones and smart speakers. It can conduct matching device activities in response to various gestures. On the TWS true wireless headphones, this method of air contact relies on the addition of sensors such as gyroscopes and accelerometers, which then work in conjunction with associated algorithms to accomplish the desired function.

Future development of TWS will also focus on gesture control, and audio manufacturers are researching this area. Apple filed for a “wearable interactive audio device” patent in 2020, indicating that the company is actively investigating the implementation of air-to-air interactive functionalities by adding more sensors to provide future AirPods customers with more options.

Translation capability

Novel use of intelligent voice interaction is the translation feature. The superior products are the Xiaodu True Wireless Smart earbuds XPods and the iFLYBUDS iFLYBUDS. Both items are executed through their App. The element of translating the voice during the conversation and translated material will be recorded in real-time on the mobile phone interface for reference. This function is primarily intended for specific conditions and may not be ubiquitous in the future development of TWS headsets, but it is a crucial path for TWS headset development.

Pressure measurement integrated

Combining numerous ways must be the most effective strategy to improve the user experience in interactive operation solutions. Not only can it expand the available control possibilities, but it can also allow consumers more freedom of choice and meet their individualized use requirements.

Apple AirPods and Huawei Freebuds Pro are two TWS earbuds that are well-received on the market for pressure sensing. The Huawei FreeBuds Pro genuine wireless noise reduction earbuds with many interactive features are the complete offering on the market. In addition to integrating two control techniques, touch, and pressure sensing, it also offers the identification of bone voiceprints.

5. Health monitoring applications: heart rate and hearing aid

With the fast development of Bluetooth headsets and associated technologies, the product capabilities of modern TWS true wireless headsets have been significantly enhanced. Hearing aids, health tests, and other tasks have long been prioritized for brand items and customers. Consequently, many firms are currently studying this field by integrating headset solutions with health monitoring, auxiliary capabilities, and other features.

Health examination

The health monitoring function has always been an essential development path for intelligent wearable devices. Previously, it was more developed in bracelets and watches. In addition to being near the body and convenient to wear, TWS earphones feature properties that make them well-suited for health detecting tasks. Bose Sleepbuds 2 are one example of such a product. The earplugs will play sleep-aid rhythms to assist users in falling asleep, record sleep status and stage, and provide sleep quality reports via the app. The content consists of the percentage of deep sleep, the rate of light sleep, the number of awake, the number of repositioning, and the most prevalent sleeping position. In the future, additional TWS headsets will have health sensing capabilities to improve the user experience.

6. Adaptive active noise reduction

Active noise reduction was used initially for headphones with noise reduction since the headphone’s earmuffs can offer passive physical noise reduction. In addition, the earmuffs provide sufficient area for effective active noise suppression. It is possible to realize that Bose and Sony are well-known manufacturers in this regard.

Active noise reduction

When Apple AirPods Pro coupled active noise reduction with TWS true wireless earbuds, the product immediately gained popularity on the market, and active noise reduction moved from a niche feature to a function in high demand.

Diverse companies have progressively introduced headsets that offer active noise reduction in 2020 to define the market and increase the competitiveness of their goods. Even while the current active noise reduction earphones need an in-ear shape to accomplish superior noise reduction, the wearing comfort is lower than that of the semi-in-ear with an open ear canal design. Wearing comfort is low because the noise reduction function causes ear pressure and pain for certain sensitive persons. In the future, with the development of intelligent adaptive noise reduction technology and the introduction of open noise reduction headphones, the comfort of noise reduction headphones will continue to be enhanced to fulfill the noise reduction requirements of various individuals.

AI calls noise reduction.

According to a poll of users, the most often used feature after purchasing TWS earbuds is the ability to make phone conversations. In everyday life, the contexts in which we make phone calls are vibrant and intricate. Subways, buses, roadways, restaurants, workplaces, study rooms, Etc., are formidable obstacles to the headset’s call function.

Consequently, the feature of call noise suppression has become a must for TWS headphones. Currently, on the market, TWS earphones primarily employ three approaches to minimize call noise processing: the single-microphone solution, the dual-microphone array solution, and the acceleration Sensors, VPU, and in-ear microphones aid in implementation. However, classic call noise reduction methods rely heavily on multi-microphone arrays, which are complex, expensive, and limiting in terms of noise reduction situations. In the foreseeable future, the need for AI call noise reduction will expand dramatically, and more players will be eager to join the game.

True Wireless Earbuds Material and Engineering Analysis

1. The primary control circuit

In TWS true wireless earbuds, the master chip is of great importance. Currently, a multitude of vendors has launched the TWS main control chip market. The extensive and fully integrated Bluetooth audio SoC offers a solid assurance for implementing several TWS earphone functionalities.

In contrast to mobile phones and headsets, which have relatively large volumes, TWS earphones have more strict requirements for the size and integration of the primary control chip owing to its mobility. In addition, the integration of several additional configurations, such as noise reduction and functional sensors, increases the need for cavity space use and chip integration.

ANC Integration

In TWS true wireless earbuds that allow active noise reduction, the ANC noise reduction chip and the noise reduction algorithm are crucial for achieving a more significant noise reduction effect, in addition to the reasons for the design of the external headphones discussed above. However, the majority of contemporary TWS headphones lack this feature. ANC noise reduction chips and Bluetooth master SOC provide superior noise reduction capabilities.

Edifier TWS NB2, Urbanista London, 233621 Zen, OPPO Enco X, OPPO Enco W51, and other devices that employ Bluetooth audio SOCs with integrated ANC noise reduction technology, such as Qualcomm’s flagship chip QCC5124, Hengxuan BES2500Y, Zhongke Lanxun BT889X, etc., are examples of wireless noise-canceling headset products that have emerged with the development of TWS earphones.

In addition to lowering the size of the motherboard, it provides excellent noise reduction performance. Therefore, the market for main control chips with integrated ANC noise reduction features may expand and become dominant in the following years.

Smaller size

High integration and chip size have a reciprocal effect on one another. As the level of integration of the main control chip improves, the size of the chip likewise grows. The future path of development for TWS true wireless headsets will unavoidably trend toward making them smaller and lighter, enhancing wearing comfort and full-scene applications. This necessitates incorporating more advanced chip production technologies, the diminution of chip size, and the optimal use of the headset inside. Space, lower the headset’s size. Miniaturization of the master chip will thus be a future development trend.

Higher processing capacity

People have been using TWS earphones for extended periods and in various situations, which has increased the desire for additional practical applications. TWS’s ten primary development trends will be Features Audio, intelligent interaction, hearing aid health monitoring, active noise reduction, and other tasks needed for producers of Bluetooth master chips to seek more computer capacity continually.

SiP package

Apple pioneered the implementation of the H1 chip utilizing the SiP (System in Package) system-in-package on AirPods Pro, while the primary control chip of the newly introduced Samsung Galaxy Buds Pro also used a similar packaging method.

The SiP packaging may significantly decrease the circuit carrier’s size, but the process is more sophisticated, necessitating increased requirements for chip architecture, stacking, and heat dissipation. SiP technology will be able to give a more optimal solution as the need for smaller smart devices, such as TWS headsets, continues to develop, as does the desire for multifunctional integration and low-power main control chips.

2. Sensor

Numerous TWS true wireless earphone functionalities need the integration of appropriate sensors for hardware support. The primary sensor units of modern TWS headphones include speakers for music playing, Optical sensors for ear recognition and MEMS microphones for active noise reduction during conversation recognition, bone voiceprint sensors for call noise reduction, and a six-axis, 360-degree surround sound sensor, among others.

Micro electro-mechanical system mic

The preceding microphones in TWS headphones are mainly utilized for voice calls. As a result of the incorporation of ANC and ENC noise reduction technologies into TWS earphones, multi-microphone coordination solutions have been extensively used to provide more significant noise reduction effects, and the performance requirements of microphones are also continually increasing. Microelectromechanical system (MEMS) silicon microphones have become the norm due to their various advantages, such as tiny size, SMT, and high stability.

In-ear detection

In the fast growth of TWS earbuds, in-ear detection is a popular and novel function. It uses the optical sensor to stop and restart playing when the headset is removed and reinserted. The user experience is effectively enhanced, and It may minimize power consumption while the device is not in use to produce a power-saving benefit. In the present entry-level market for TWS earphones, many models are not yet equipped with in-ear detection, but this will soon become a standard function.

Bone Vibration Sensor

The bone vibration sensor captures just the vibration information of the vocal cords and transforms it into audio signals; the two-way call sound information received by the headset is free of surrounding noise (one way is transmitted through the air and picked up by the microphone, and the other is transmitted through the bone vibration. )

By comparing noise reduction methods, ambient noise is evaluated and reduced to improve the quality of voice calls. Wind noise and ambient noise suppression are also improved compared to the conventional dual-microphone approach.

Currently, the true wireless earphones of Apple, Samsung, Edifier, and other brands use a bone vibration sensor and a multi-microphone call noise reduction solution; additionally, This sort of sensor may be utilized for bone voiceprint recognition technologies, such as Huawei’s FreeBuds3 and FreeBuds Pro, which enhances the user experience and increases the possibilities of TWS earbuds.

Six-axis sensor

Six-axis sensor, integrated acceleration, and gyroscope, primarily to realize the tapping function and head rotation tracking, provide a more prosperous interactive design supplement, head control to answer and reject calls, fine head motion tracking, used to achieve the 360-degree sound effect function of the headset.

Speaker

In the early phases of the development of TWS headphones, consumers often criticized the sound quality of headsets owing to the limits of Bluetooth transmission. As described above, Bluetooth audio transmission limits quickly diminish due to Bluetooth technology development, including Bluetooth 5.2 and LE Audio.

On the other side, the speaker unit determines the sound quality. The speaker is the headphone product’s most fundamental arrangement. Presently, the dynamic unit is the primary use of the speaker product in TWS headphones. The dynamic unit has a solid low-frequency performance but cannot account for the outstanding mid-to-high frequency impact owing to space constraints.

The dynamic unit is commonly used in hearing aid devices because of its compact size, low power consumption, and great sensitivity. However, with the fast development of TWS earphones, several mid-to-high-end brands have started to use moving iron elements to increase sound quality. In addition, some items feature double-acting iron units to improve the sound quality.

Compared to the moving coil unit, the moving iron unit is superior in middle and high-frequency performance and can deliver more clarity and detail, but it cannot match the moving coil unit’s incredible power at low frequency. Consequently, the ring iron unit has been developed by combining the moving coil and the moving iron, and the various audio frequencies may be handled individually for improved results. The downside is the comparatively bigger size of the ring iron unit, which places more demands on the structural design of the product.

In future TWS earphones, unit combinations such as moving coil, moving iron, coil iron, and dual moving coil will continue to maintain diversified development, allowing consumers to choose their desired sound quality. To accommodate the size of true wireless earphones, unit miniaturization is also on the rise.

3. TWS power management chip for headphones

The power management chip plays a crucial role in guaranteeing the battery life of the TWS headphones. The power management chip is used mainly for the charging and discharging of the earphones, Along with real-time safeguards against short circuits, overcurrent, overheating, overcharging, and over-discharging when the battery is being charged and discharged.

The power management chip’s charging and discharging power are less than that of traditional equipment. The TWS earphones, which have extremely high requirements for portability, have relatively high requirements for safety, low power consumption, high voltage resistance, high integration, and high efficiency.

The power management chip for TWS earphones features a highly integrated SoC single chip, integrated MCU functions, charging management two-in-one, three-in-one, and even six-in-one power solutions. By 2021, this tendency may intensify, and various manufacturers will provide power management chip solutions with enhanced performance.

TWS headphones battery

The evolution of battery technology is still essential to developing TWS devices. Before the advent of Apple AirPods, battery life was the primary reason people did not generally adopt Bluetooth headphones. In terms of battery life, the Apple AirPods changed lanes to pass the competition, and the solution of employing earbuds and charging pods contributed to the rapid expansion of the market.

In order to accommodate the many forms developed throughout the development of TWS headphones, TWS headset batteries are primarily separated into three types: polymer soft-pack batteries, button batteries, and pin-type batteries.

Among them, polymer soft pack battery technology is significantly better developed, and its cost is relatively cheap. Due to the necessity to adapt to various earphone forms, it has taken on square, long, and button designs; button batteries benefit from their tiny size and can utilize headphones well. The benefits of internal space, simple positive and negative electrode welding, etc., are progressively gaining popularity in TWS headset batteries; the pin type is primarily used in handle-shaped Bluetooth headsets and has a limited market share.

Wireless charging and rapid charging

In addition to the solution of the charging compartment on TWS headphones, the development of rapid charging technology is a barrier to the advancement of battery technology. Improve the pleasure of using TWS headset products by rapidly replenishing power via quick charging, mitigating the effects of short battery life, and reducing the impact of short battery life.

Introducing wireless charging technology to TWS earbuds is intended to increase charging convenience. The charging box is put on the charging board while the earphones are not in use; when the earphones are used, the energy is replenished in real-time. Mobile phone devices have increasingly embraced the wireless charging capability in their entirety. In order to achieve a perfect fit between peripheral audio equipment and charging accessories, the TWS true wireless earbuds include the simple ability to be charged in the opposite direction of the mobile phone.

Insights and Conclusions

Not available with free report content. Contact us for more details.

Let’s work together on your

next research project

We’re driven by our passion to uncover deep, data-driven consumer insights.